The world economy is shifting, as Asia becomes the largest trading region, fuelling the rise of a newly affluent community and a different breed of corporations.

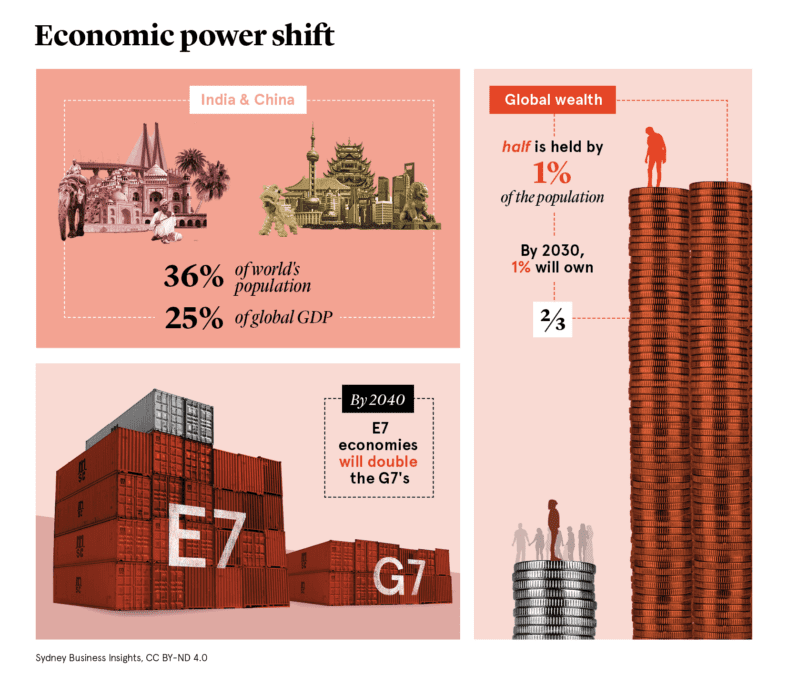

Just two countries, China and India, account for 36% of the world’s population and 25% of global GDP.

We will see a restructuring of the global economy with non-OECD economies expected to account for 57% of GDP by 2030. The economic influence of the G7 countries will shift to the Emerging 7. By 2040, these E7 economies will be double that of the G7.

India and China will take up a rising share of global output as the world’s economic centre of gravity continues to shift toward Asia. China’s GDP will likely surpass that of the US by 2035, while India’s GDP could do so by 2075. However, the individual purchasing power of citizens in the West will likely remain higher than that of consumers in both China and India, and it is probable that no country will be clearly economically dominant.

By 2030, 4.8 billion people will be middle class. This globalised, more affluent community will possess significant purchasing power. Two-thirds of them will reside in the Asia Pacific region.

Globalisation itself has produced unequal returns. The shift in wealth to the rich will accelerate. Currently, about half of the world’s wealth is held by only 1% of the population. By 2030, the richest 1% will own two thirds.

Rising inequality is also challenging trust in traditional global economic institutions and agreements. Geopolitical tensions, leading to more frequent trade wars, rising protectionism, and the potential for military conflict, will drive uncertainty and instability.

How will individuals, corporations, and governments renegotiate their expectations of one another, in an era of accelerating individualisation and rapidly changing economies?

Economic power shifts of this magnitude will fundamentally alter national and individual prosperity – these opportunities, along with significant risks, will play out on the world stage.

Ip, C. (2021). ‘Will China and its E7 emerging economies render the G7 a redundant clique?’, South China Morning Post 5/12/21. Available at: https://www.scmp.com/economy/global-economy/article/3158314/will-china-and-its-e7-emerging-economies-render-g7-redundant

Gurria, A. (2011). ‘A better global governance: What is at stake?’, OECD. Available at: https://www.oecd.org/china/abetterglobalgovernancewhatisatstake.htm

Saul, D. (2022). ‘China and India will Overtake U.S. Economically by 2075, Goldman Sachs Economists Say,’ Forbes 6/12/22. Available at: https://www.forbes.com/sites/dereksaul/2022/12/06/china-and-india-will-overtake-us-economically-by-2075-goldman-sachs-economists-say/

Rajah, R., Leng, A. (2022). ‘Revising down the rise of China’, Lowy Institute. Available at:

https://www.lowyinstitute.org/publications/revising-down-rise-china

Wallach, O. (2022). ‘The World’s Growing Middle Class (2020-2030)’, Visual Capitalist. Available at: https://elements.visualcapitalist.com/the-worlds-growing-middle-class-2020-2030/

Savage, M. (2018). ‘Richest 1% on target to own two-thirds of all wealth by 2030’, The Guardian. Available at: https://www.theguardian.com/business/2018/apr/07/global-inequality-tipping-point-2030

We believe in open and honest access to knowledge. We use a Creative Commons Attribution NoDerivatives licence for our articles and podcasts, so you can republish them for free, online or in print.

The latest on economic power shift

Archive

Board games at Disney, the fight of the figureheads

Disney's star-studded board faces activist investor pressure, but do the celebrity directors have the right expertise? What's the implication for other companies facing activist shareholders?

Buy Now Pay Later – what are the pitfalls?

Around a quarter of Australian adults have used a Buy Now, Pay Later service. What does the industry's increasing influence mean for younger and at-risk consumers?

The rise of the value destroyers – activist short sellers

Do activist short sellers actively destroy the value of firm investments, in addition to their role in ‘correcting mispricing / overvaluation’?

The emerging untruths of a global economy

The developing economic arrangements will not be a return to last century’s certainties.

Mental health plays a big role in advancing the economy – we need a measure beyond GDP

Mental health plays a significant role in productivity but is often overlooked. To maintain its promising economic growth, Indonesia must put its people’s well-being into the calculation.

Not just retail and restaurants: Australia’s new high tech Asian entrepreneurs

Who are this new generation of Asian Australian entrepreneurs and what makes them successful?

Keeping it local – the new supply chain vibe

Resilience has become a saviour term but businesses can move beyond just mitigating supply chain risk.

Temu – Chinese apps going global

This week: Pinduoduo’s Temu marks another high-profile entry in the e-commerce market from a Chinese tech giant.