Ameeta Jain and Fabienne Michaux

Is COVID-19 the catalyst for increasing impact investments?

Australians have a social conscience. At the loss of significant personal freedoms, they have co-operated with health restrictions imposed by state and federal governments during the COVID19 pandemic, for the benefit of society.

Similarly, Australians have invested almost $20 billion in so-called “impact investments” over the last two years – a staggering 250% jump since 2018. This surge into investing for a ‘social good’ is set to increase. Our research shows Australians are looking to invest five times as much – $100 billion over the next five years – in products that promise not only to return financial returns, but are also committed to generate positive social and/or environmental returns.

Social good a growing investment

In 2018 the international impact investing market was worth US$502 billion. Prior to COVID-19 it was expected to reach US$1 trillion by 2024.

However we expect the pandemic shock will boost the impact investment market: like other economic upheavals the pandemic has created winners and losers. Despite the impact on individual economies across the world, the major stock indices are virtually at the same level as at the start of the pandemic.

As impact investments are sustainable, they can and do represent an attractive proposition in the current environment.

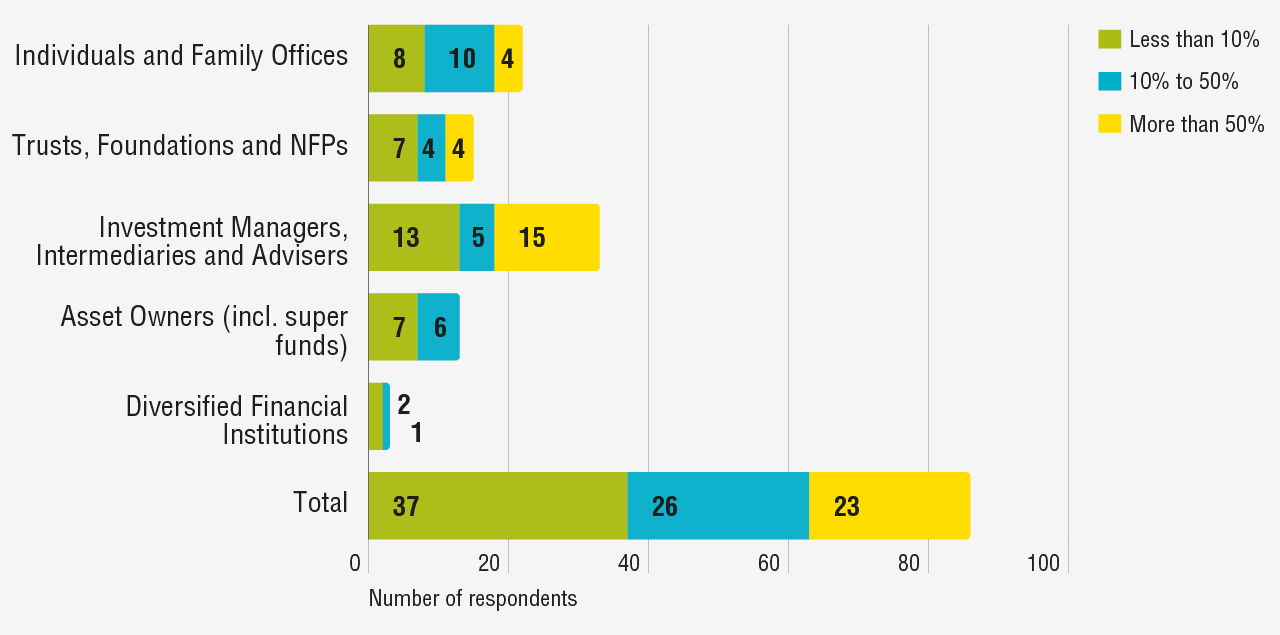

Interest and activity in impact investing is strengthening across all investor categories including individuals and family offices, trusts, foundations and not-for-profits, investment managers, intermediaries and advisors, asset owners and diversified financial institutions. Smaller investors typically allocate a larger proportion of their assets under management to impact investments, but smaller increases in allocation amongst larger institutions has a bigger bearing on activity overall. Importantly, we are seeing more dedicated impact managers and intermediaries, and while accounting for a small proportion of assets under management overall (0.3% of AUM), account for 76% of impact investments managed by all investment managers, intermediaries and advisors.

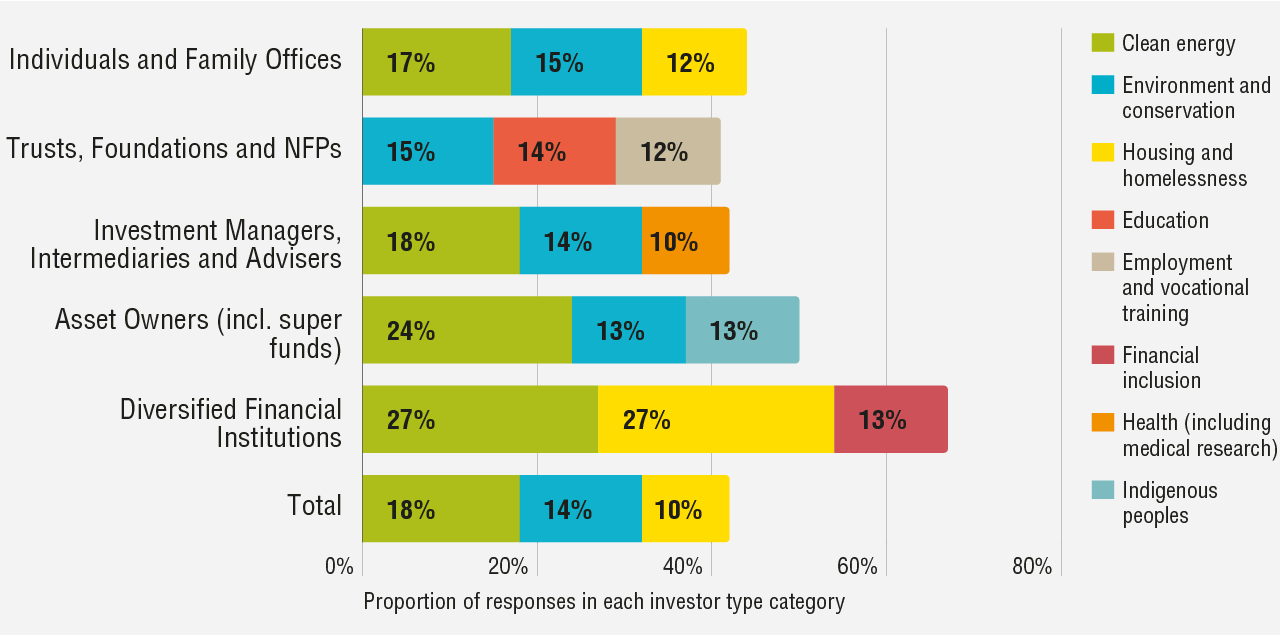

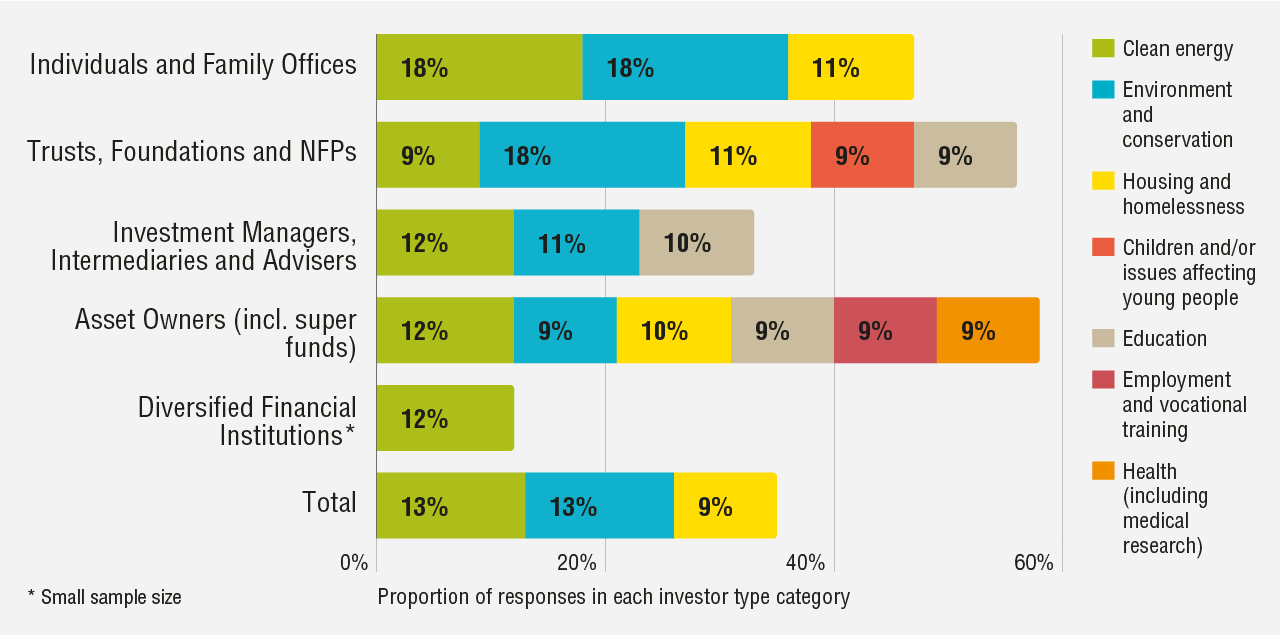

Investments offering positive environmental outcomes are by far the most popular products (87% of all investments) although this seems to be due to what’s on offer, with 63% of investors agnostic whether their impact investments target social or environmental outcomes. Most investors expect a competitive risk adjusted financial return on their impact investments and over 90% of investors’ state their impact investments are meeting or exceeding both their impact and financial return expectations.

Currently, the global impact investing market is small (US$502 billion) relative to the aggregate pools of investment capital (US$100 trillion).

Source: Australian Impact Investor Insights, Activity and Performance Report 2020

Pandemic highlights need for new investment framework

The worldwide COVID-19 pandemic has brought into even sharper focus how intertwined and interdependent our economic, social and environmental fortunes are and has helped people conceptualise the scale of the task ahead in terms of the consequences of not mitigating the risks of inequality, climate change, biodiversity loss, and the continuing encroachment of human civilisation on our natural systems. The pandemic has highlighted the interconnectedness of all human endeavour and all countries by causing similar human and economic devastation globally.

For large scale institutional investors whose assets under management now often exceed national GDPs, these macro or systemic risks (such as the pandemic) are increasingly unavoidable.

The pandemic has provided an opportunity for all investors to reflect not just on the return on their investments but also the potential impact of these investments on society.

Investors are increasingly looking for new opportunities to mitigate longer term and systemic risks and make a positive impact for people and the planet – recognising the two are increasingly interdependent, and that community and member expectations increasingly demand it. Our report highlights that investors are increasingly cognisant of the demands of society and interested in impact investing. For example some investors have used a measure of reduction of the actual quantity of CO2 emissions as a metric.

Source: Australian Impact Investor Insights, Activity and Performance Report 2020

Source: Australian Impact Investor Insights, Activity and Performance Report 2020

There is no reason why impact investing cannot become more mainstream if impact integrity and standards are available such as those currently under development (UNDP SDG Impact Practice Assurance Standards). The challenge for global investors and governments is to support impact investments as a potent tool in the redevelopment of a post-COVID sustainable and more equitable world. Is the social conscience of Australian investors strong enough to increase their impact investments?

This is part of a series of insights related to Coronavirus (COVID-19) and its impact on business.

Dr Ameeta Jain is a Senior Lecturer in the Department of Finance in Deakin Business School. Her primary area of research is Corporate Social Responsibility.

Fabienne is a Professor of Practice (Finance) at the Deakin Business School as well as Co-Chair of the Australian Sustainable Finance Initiative’s Technical Working Group.

Share

We believe in open and honest access to knowledge. We use a Creative Commons Attribution NoDerivatives licence for our articles and podcasts, so you can republish them for free, online or in print.