SDGs by 2030 – are we on track?

Reducing political corruption raises business investments

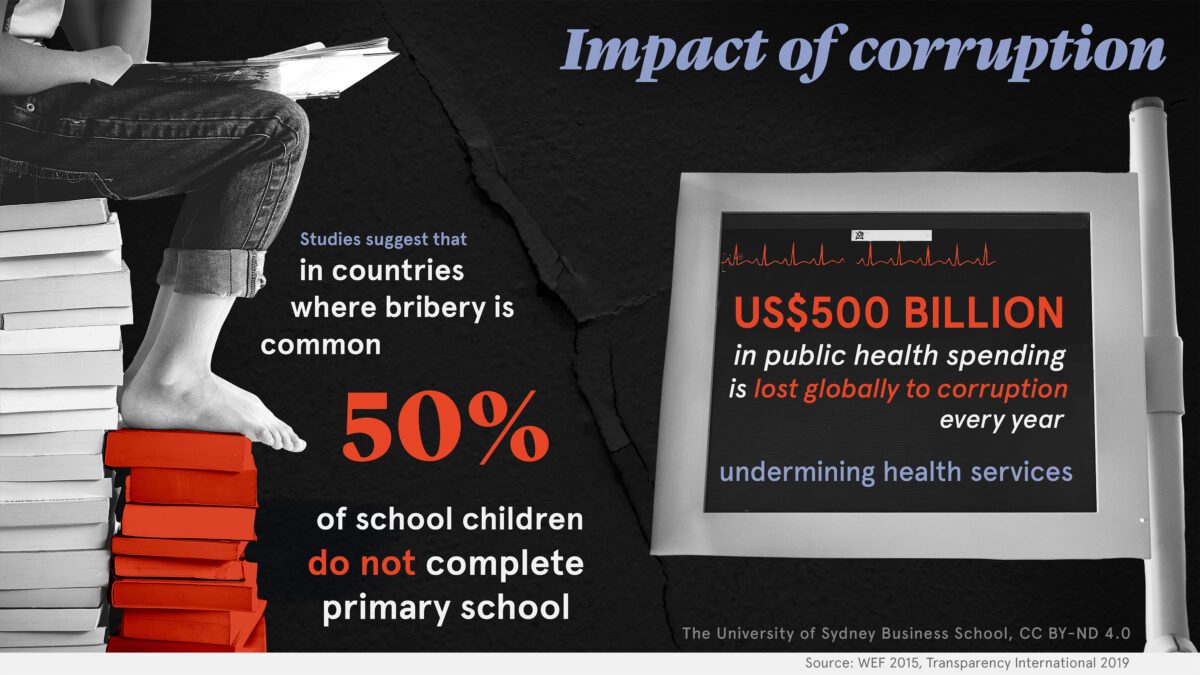

How much does political corruption cost the community? We set out to quantify the negativities of corruption in terms of lost investment, jobs not created, and hampered economic growth.

A far-reaching corruption busting program in China that saw public officials arrested openly in front of their colleagues, family and the general public proved to be a valuable case study.

SDG 16 aims to bring justice to every corner of the globe by fostering effective, accountable, and inclusive institutions. These institutions will drive transparency and elevate living standards for all. A key target in this goal is the fight against corruption, which specifically addresses the abuse of public positions, ranks, or statuses by government officials to secure personal gains.

Our research team wanted to find out if it is possible to show the effect of a concerted reduction in corruption on corporate investment strategy.

The problem with studying corruption is it’s normally hidden, making it very hard to assess. In 2012 the Chinese Government launched an expansive anti-corruption program targeting bureaucrats across different regions. This included some very high-profile public arrests of government officials carried out across China. Specifically, we use the public arrests as an exogenous shock to test whether a visible reduction in corruption changes corporate acquisitions. We measured changes in these major corporate investments that came from outside the region that was being ‘cleaned up’.

We observed a surge in corporate mergers and acquisitions (M&As) following the public arrests of high-ranking officials, such as the first deputy bureau chief or above, in the city during the anti-corruption campaign. This increased activity was driven by companies feeling more confident about making substantial investments in regions where they saw local governments actively addressing corruption. Not only did the number of M&As grow but the dollar value of these corporate investments also rose (a 40% increase in the number of deals and a 268.7% increase in the dollar amount). Overall, more M&As took place and the size of the deals also became larger.

The overall message is that political corruption is value destroying. It erodes public trust and stifles business confidence, investment activity and economic growth. Eliminating or mitigating corruption improves the business investment environment. Without strong institutions there is the potential for considerable misallocation of resources and under-investment.

Perceptions matter a lot. It’s not sufficient to just have the right laws in place – the rules have to be seen to be enforced.

Addressing corruption is crucial for fostering economic prosperity. Our study highlights that people are hesitant to invest in environments where they perceive they won’t receive fair returns. Over time, investment dries up and communities will suffer worse economic outcomes.

Sustainable Development Goal (SDG) target addressed:

Target 16.5 Substantially reduce corruption and bribery in all their forms

Resources

Background:

Corruption can significantly influence various economic activities, including corporate investments and takeovers. In this assignment, students will explore how corruption, particularly in their local or national context, impacts economic and business outcomes. They will also consider ways to uncover and measure the effects of corruption on these outcomes, drawing on techniques such as regression analysis used in a recent study on China’s anti-corruption campaign (Huang, et al., 2023).

Assignment Prompt:

1. Understanding the Context:

• Provide a brief overview of how corruption can impact corporate activities, including takeovers and investments.

• Describe how anti-corruption measures might alter this dynamic, including the potential for increased cross-region takeover activities and deal volume.

2. Conceptualizing Corruption’s Impact:

• Choose a specific geographic region or year of interest to focus on (e.g., looking at time-series data of Australia or different countries in 2017).

• Identify possible sources of publicly available information that can help uncover instances of corruption in your chosen context (e.g., government reports, news articles, public arrest records).

The political corruption index can be collected at: https://ourworldindata.org/grapher/political-corruption-index

The economic outcomes can be collected at: https://stats.oecd.org/

3. Linking Corruption to Economic Outcomes:

• Develop a framework for tracking and measuring how corruption or anti-corruption efforts in your chosen context relate to corporate investments or other economic activities.

• Put together the corruption index and the economic outcome of interest for the selected county or year.

• Consider how techniques such as panel or cross-sectional regression analysis could be applied in this context to draw meaningful conclusions.

• Students may choose your preferred programming platforms to perform the regression analysis (e.g., Excel, Stata, and Python)

4. Provocative Discussion:

• Reflect on the broader implications of your findings. How might the reduction or persistence of corruption in your chosen context affect the region’s overall economic development?

• Propose policy recommendations or practical steps that could be taken to further mitigate corruption and stimulate economic growth.

Expected Outcomes: Students should deliver a well-structured written report or presentation that:

• Shows an understanding of how corruption impacts investments and economic development.

• Demonstrates the ability to conceptualize a research approach using publicly available information.

• Provides meaningful analysis and discussion on how to uncover and measure corruption’s impact, potentially applying methods such as DID.

• Suggests recommendations for policymakers or stakeholders in the chosen context.

________________________________________

References

Huang, C., Jin, Z., Tian, S., & Wu, E. (2023). The real effects of corruption on M&A flows: Evidence from China’s anti-corruption campaign. Journal of Banking & Finance, 150, 106815.

Book

- Ray Fisman, Miriam A. Golden. (2017). Corruption: what everyone needs to know. Oxford University Press, New York, United States.

Article

- Huang, C., Jin, Z., Tian, S., Wu, E. (2023). The real effects of corruption on M&A flows: Evidence from China’s anti-corruption campaign. Journal of Banking and Finance, 150.

Podcasts and videos

Websites

- International Monetary Fund: Tackling Corruption in Government

- Transparency International: What is corruption

- The U4 Anti-Corruption Resource Centre

- World Economic Forum: Want to end poverty? Start with corruption

- United Nations: Meetings Coverage and Press Releases

Reports

Dr Eliza Wu is a Professor in Finance. An integral part of Eliza’s research program has centred around modelling and understanding what drives asset price movements and risk transmission across international financial markets (stocks, bonds, credit derivatives and currency markets).

Share

We believe in open and honest access to knowledge. We use a Creative Commons Attribution NoDerivatives licence for our articles and podcasts, so you can republish them for free, online or in print.